south dakota used vehicle sales tax rate

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Mobile Manufactured homes are subject to the 4 initial registration fee.

New Vehicle Sales Plunged Further In August Amid Inventory Shortages Production Cuts Chip Shortage Wreaks Havoc Wolf Street

What Rates may Municipalities Impose.

. Motor Vehicles Sales and Purchases. South Dakotas excise tax on Spirits is ranked 31 out of the 50 states. South dakota used vehicle sales tax rate.

4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable. The south dakota dmv registration fees youll owe. South Dakotas sales and use tax rate is 45 percent.

What is South Dakotas Sales Tax Rate. Average Local State Sales Tax. 2022 List of South Dakota Local Sales Tax Rates.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. The South Dakota excise tax on liquor is 463 per gallon lower then 62 of the other 50 states.

The december 2020 total local sales tax rate was also 6500. This tax shall be in lieu. Ad Lookup Sales Tax Rates For Free.

With local taxes the total sales tax rate is between 4500 and 7500. Tax and Tags Calculator. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales. The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. Car sales tax in South Dakota is 4 of the price of the car.

The highest sales tax is in Roslyn with a. The county the vehicle is registered in. In addition for a car purchased in South Dakota there are other applicable fees including registration title and.

South Dakota has recent rate changes Thu. The cost of a vehicle. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes.

All car sales in South Dakota are subject to the 4 statewide sales tax. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. South Dakota municipalities may impose a municipal.

4 State Sales Tax and Use Tax Applies to all sales or purchases of taxable. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. The base state sales tax rate in south dakota is 45.

If purchased in south dakota an atv is subject to the 4 motor vehicle excise tax. Ad Lookup Sales Tax Rates For Free. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

South Dakota Taxes and Rates. Some llcs pay south dakota sales tax on. 31 rows The state sales tax rate in South Dakota is 4500.

Different areas have varying additional sales taxes as well. Can I import a vehicle into South. 31 rows The state sales tax rate in South Dakota is 4500.

Interactive Tax Map Unlimited Use. A person shall pay an excise tax at the rate of four percent on the purchase of an off-road vehicle as defined by 32-3-1 and required to be titled pursuant to 32-20-12. The South Dakota sales tax and use tax rates are 45.

You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. Average Sales Tax With Local. Interactive Tax Map Unlimited Use.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Amazon Sales Tax A Compliance Guide For Sellers Sellics

Sales Tax On Cars And Vehicles In Vermont

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Amazon Sales Tax A Compliance Guide For Sellers Sellics

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Pennsylvania Sales Tax Small Business Guide Truic

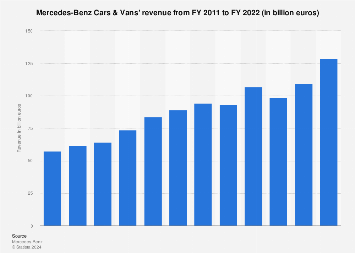

Mercedes Benz Cars Vans Revenue 2011 2021 Statista

Sales Tax On Cars And Vehicles In California

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New Vehicle Sales Plunged Further In August Amid Inventory Shortages Production Cuts Chip Shortage Wreaks Havoc Wolf Street

What Is The Difference Between Sales Tax And Use Tax Sales Tax Institute

Amazon Sales Tax A Compliance Guide For Sellers Sellics

Your Guide To Cross Border Shopping

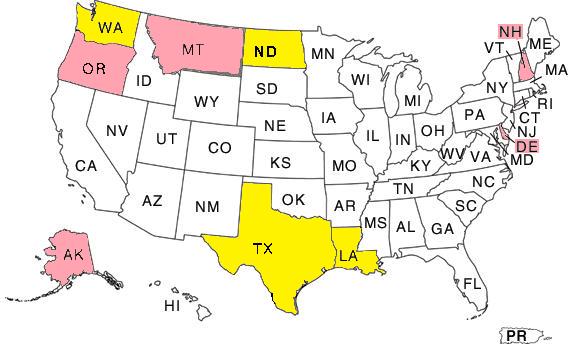

Doing Business In The United States Federal Tax Issues Pwc

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

New Vehicle Sales Plunged Further In August Amid Inventory Shortages Production Cuts Chip Shortage Wreaks Havoc Wolf Street

Brokers Hit The Ground Running On Fatca Compliance Tax Accountant Tax Return Tax Season