nassau county tax rate dmv

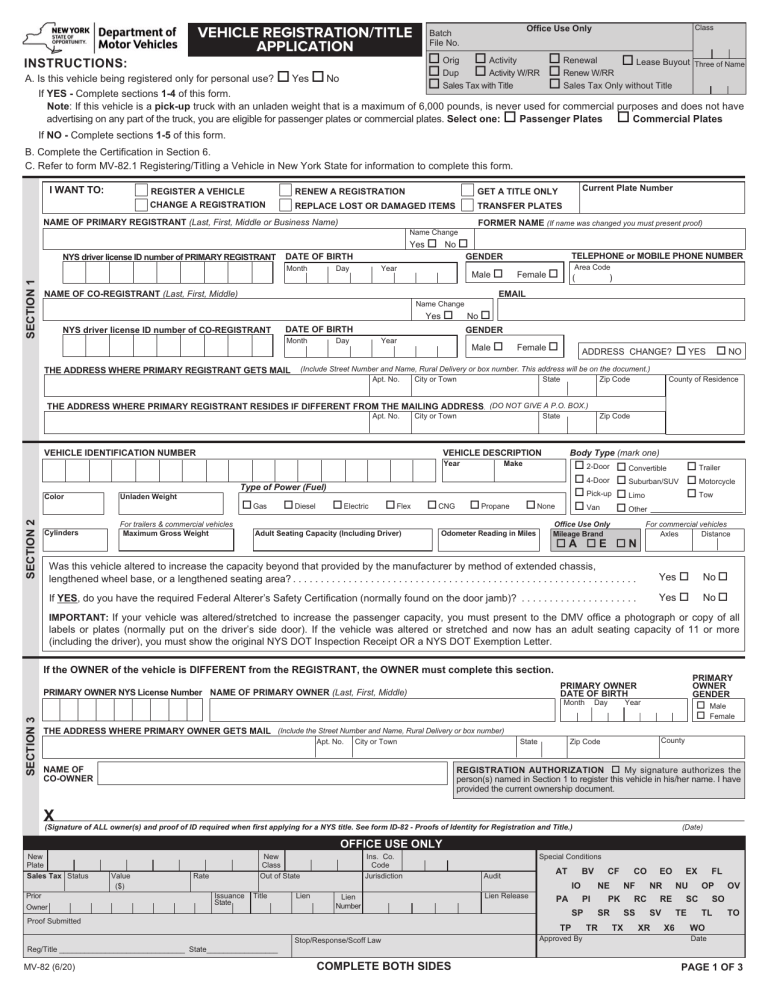

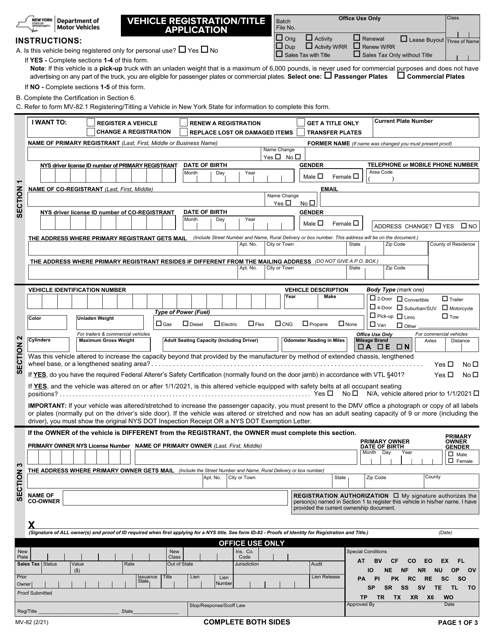

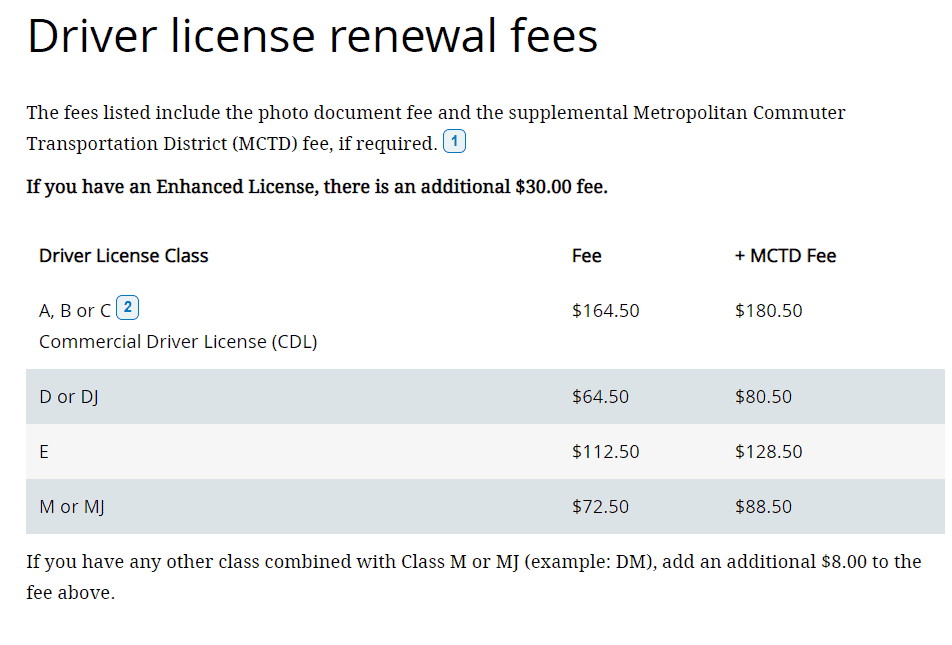

Sales tax see sales tax information title certificate fee of 5000. You will need either 1 the PIN from your mailed renewal notice or 2 your license plate and birthday.

Follow Us MENU.

. Shopping Center Massapequa NY 11758 Hours. New York collects a 4 state sales tax rate on the purchase of all vehicles. Please include your name and phone number.

Building Engineering and Planning Departments cannot currently accept online payments after 400 PM or on weekends and Holidays. Renew your vehicle or vessel registration in Nassau County FL. Drivers license motorcycle and CDL.

A tax collector service fee is added to motorist services fees. 927 Carmans Road Carmans Plaza. The New York state sales tax rate is currently.

How to Challenge Your Assessment. Prove that sales tax was paid. Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by.

If this is the original registration of your vehicle in addition to the registration fee and county use tax you must pay. The tax collector is responsible for collection and disbursement of this tax. Notice Impact Fee Rates 11-10-2020.

Passing the New York written exam has never been easier. 3250 - 140 Plate Transfer Fee. And will likely be collected by the New York Department of Motor Vehicles and not the New York Department of Taxation and Finance.

All Nassau offices are county tax collector-sponsored service centers. An additional 1 is collected by Nassau. Many of Nassaus Florida DMV services are available online or by phone to save you time.

Computer tablet or iPhone. 15885 County Road 108 Hilliard FL 32046 Map to location. Determine the fees and taxes for passenger vehicles.

Tax Collector Office Locations Locations in Yulee Callahan Hilliard and Fernandina Beach. Nassau County Florida Tax Collector Office Disabled Motor Services - NassauTaxes. 100 money back guarantee.

801 Axinn Avenue Garden City NY 11530 Information. Monday - Friday 730AM to 5. 0 items Log InSign Up.

This resource is designed to provide information about your county government the many services and recreational programs we offer and different ways we can provide assistance to the more than 14 million residents who live here. While many counties do levy a countywide sales tax Nassau County does not. When you register a vehicle in New York at a DMV office you must either.

6 rows The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax. You can also contact the DMV office for specialty tags disability parking permits and transferring a motor vehicle or boatvessel title. The New York sales tax of 4 applies countywide.

MCTD 1 fee for the following 12 counties only. Nassau County Florida Tax Collector Office Vehicle Titles - NassauTaxes. 1-855-571-5134 Traffic Parking.

Use the both the registration fee and county use tax charts to determine your registration fee and county use tax. The 2018 United States Supreme Court decision in South Dakota v. Meli Executive Director Mail or Visit.

Registration renewal or address change online or call 850 617-2000 for more information. Nassau County Traffic Parking Violations Agency. Get My Cheatsheet Now.

Renew or replace online at MyDMV Portal. Florida Vehicle Titles are issued by this office at the. Just print and go to the DMV.

Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email Cart. Home Contact Us Motor Services Property Taxes Driver. Prove your vehicle registration is exempt from sales tax.

Welcome to Nassau Countys official website. Make a reservation for an in-person service in Nassau County. Heres how Nassau Countys maximum sales tax rate of 8875.

Rules of Procedure PDF Information for Property Owners. Home Contact Us Motor Services Property Taxes Driver Licenses Concealed Licenses Mobile Homes Birth Records Tourist Development Hunting-Fishing. 74 rows Nassau County Has No County-Level Sales Tax.

The fees for your vehicle plates 2500 your title certificate fee of 5000. DMV Cheat Sheet - Time Saver. Nassau County Tax Lien Sale.

As your County Executive I will continue to work hard to provide. There are also a county or local taxes of up to 45. Mon-Thurs 900am-1200pm 100pm-400pm Friday 900am-1200pm 100pm-500pm.

You probably also will need to pay county use tax when you register. 516-572-2389 Booted andor Towed. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in the state.

If it is after 400 PM please submit payments the next business day. To review the rules in. Nassau County Traffic Parking Violations Agency.

Additionally there is an annual 280 processing fee and a 2800 fee each time a new plate is issued. Bronx Kings Brooklyn New York Manhattan Queens Richmond Staten Island Dutchess Nassau Orange Putnam Rockland Suffolk and Westchester. Has impacted many state nexus laws and sales tax collection requirements.

1-855-571-5134 Traffic Parking. Follow Us MENU. Once in the portal you will be able to select the department and enter.

Its like having the answers before you take the test. The Nassau County sales tax rate is. Pay the sales tax.

Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 4875. In addition to the annual license tax there is an annual users fee ranging from 1500 to 2500 which goes to the particular organization for that license plate. Skip to main content.

801 Axinn Avenue Garden City NY 11530. Please click the link below to be directed to our online payment portal. See estimate registration fees and taxes for information about county use taxes.

Renewals of Driver Licenses and ID Cards. Register get plates for your vehicle. Renew your photo document no upgradeno photo After Passing CDL Road Tests Get CDL License.

Assessment Challenge Forms Instructions. If you do not have access to email please call 904-491-7400.

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Vehicle Tag Registration Nassautaxes

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

How Does Your Real Estate Tax Bill Compare To Other Parts Of The Country

What S The Issue Volume One The Urgent Need For Infrastructure Investment Open Nassau

New York Vehicle Sales Tax Fees Calculator

Form Mv 82 Download Fillable Pdf Or Fill Online Vehicle Registration Title Application New York Templateroller

What S The Issue Volume One The Urgent Need For Infrastructure Investment Open Nassau

How Much Does It Cost To Register A Car In Ny

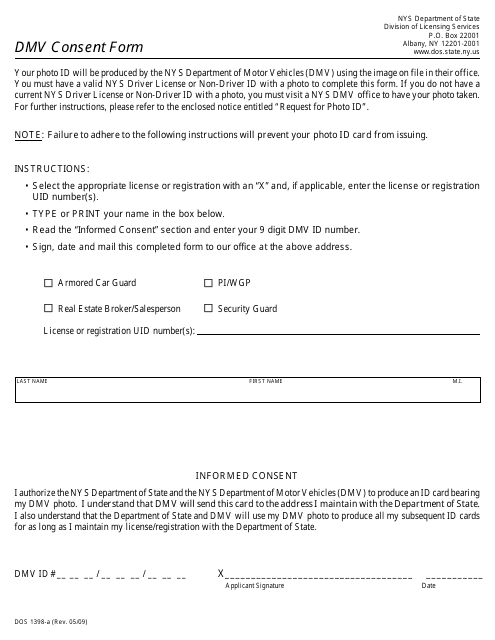

Form Dos1398 A Download Printable Pdf Or Fill Online Dmv Consent Form New York Templateroller